Save $Money$ in this economy

1. Increase your auto insurance deductibles.

2. Open an online savings account

Examples of online savings accounts

The Orange Savings Account. Great rates, no fees, no minimums.

3. Stop buying bottled water

4. Downgrade your cable plan

5. Use the library more often

6. Learn how to cook and cook consistently

7. Switch to a prepaid phone plan

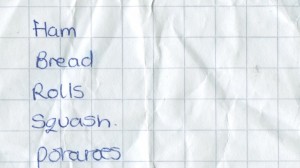

9. Create shopping lists

10. Stock up during supermarket sales

and follow these tips,

- Come to the store with a specific list of items – and don’t stray from it.

- This means planning your menu for the week and itemizing how much each meal potentially costs.

- Buy generic. It used to be that generic goods were of poor quality. This just isn’t the case anymore

- Don’t use coupons. This may sound contradictory, but coupons are often for name-brand products. 50 cents off Lunchables is still too expensive. Of course, this isn’t always the case, and coupons can be useful, but don’t think you’re saving money just because you hand over a coupon.

- In a similar vein, don’t always buy in bulk if it’s not something you use a lot. Bulk toilet paper makes sense. But a crate of ketchup may never get used in your lifetime.

- Check prices by size. A large can of a certain brand can be less than a small can of another brand.

- Stay away from convenience foods: all of them. Frozen dinners, soda, candy, cookies. Yes, it’s less fun, but you can make cookies or buy powdered drink mix and make your dinners for much cheaper.

- Be sure to always save your leftovers, and never make food that will go to waste.

- As mentioned, stay away from restaurants.

I came up with a few more.

Increase your auto insurance deductible

Cook at home more often

Make your own coffee

Use grocery bags inplace of trash cans

Downgrade your cable plan

Consolidate and pay off debt as soon as possible

Avoid unneccesary fees, atm, late fees etc

Buy what you need

Ride your bike of carpool

Plan vacations ahead of time